55+ should i use 401k to pay off mortgage after retirement

Web 5 hours agoBy that Barry means the average 401k savings rate including both employee contributions and employer matches held roughly steady at 137 down from the 138. If you withdraw 60000 from your IRA to pay off your mortgage you.

Suze Orman Pay Off Mortgage Instead Of Saving So Much For Retirement

Web According to Zigmont in 2023 your priority should be paying off debt as inflation is still high and interest rates are still rising.

. Your Goals Deserve A Strong Foundation Prudential Is Here To Assist You Today Everyday. Web 4 hours agoAltfest recommends two bond funds that mainly hold mortgage-backed securities. Discover All The Advantages Of A Reverse Mortgage Loan And Decide If One Is Right For You.

Ad Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals. Web Typically those who havent reached 59½ must pay a 10 percent penalty money withdrawn from their 401 k. Web 1 Another study revealed that 44 of 60- to 70-year-old homeowners are carrying mortgage into retirement and 32 expect it will take them more than eight years to pay it off.

Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Web After years of writing a monthly check to the bank it feels good to be able to drop that expense. Either way though this would make 5 million a very comfortable retirement nest egg for most.

Discover All The Advantages Of A Reverse Mortgage Loan And Decide If One Is Right For You. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. I contribute 6 now all going into the Roth investment with company matches.

You can only withdraw funds from your most recent 401k or 403b account for the rule of 55 to work. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. Web Retirement Account.

And if times get really tough and youve paid off your mortgage then. Thats a 100 fee for every 1000 taken out. Web The losses in our 401k plans have set back our retirement plans.

Invest While Still Paying Off Debt. Web Scenario 1. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You.

If you meet the requirements for all of. Web 2 hours agoDexComs price-to-earnings ratio PE of 140 makes it appear less of a buy than Abbotts PE of about 26. By paying off your mortgage loan you get rid of one of your biggest monthly expenses in retirement.

Web While the combined 25500 33000 if youre 50 or older that you can contribute to a 401k and IRA may seem like an excessive amount to save for. There are some understandable questions you might encounter as you plan for retirPaying down a mortgage with funds from your 401 k can reduce your monthly. A paydown can also allow you to stop paying interest on the mortgage especially if.

Many credit cards now charge 20. But the reason the stock is more expensive is DexComs. Web No More Monthly Payment.

Web Now the eight-times rule of thumb is based on a retirement age of 65. How Much Interest Can You Save By Increasing Your Mortgage Payment. Significant disadvantages to the move include reduced assets in retire See more.

Web The return on waiting to claim Social Security is huge He also pointed out that if youre paying say 25 on your mortgage and you pay it off you essentially just. 2 3 It typically takes someone 20 years to pay off their student loans but it can take up to 45 years. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today.

Yes youll still have healthcare expenses and. Web Using your retirement savings to make mortgage payments could also trigger taxes. Web If you take money out of a 401 k before youre 59½ that amount is also typically subject to a 10 penalty in addition to the regular tax although there are some.

The Angel Oak Multi-Strategy Income Fund has 29 billion in assets under.

Q A Should I Pay Off Mortgage With My 401 K

Dave Ramsey S Early Mortgage Pay Off Advice Good Idea

Should I Pay Off My Mortgage With Money From My 401 K The Washington Post

:max_bytes(150000):strip_icc()/353fbcc708d5e92ab3abbe45b48d1e2a_new1-58a8f65b81204f369a7eb2bf79a42cb8.jpg)

Pros And Cons Of Paying Off Mortgage Before Retirement

Should You Pay Off Your Mortgage In Retirement Experts Weigh In

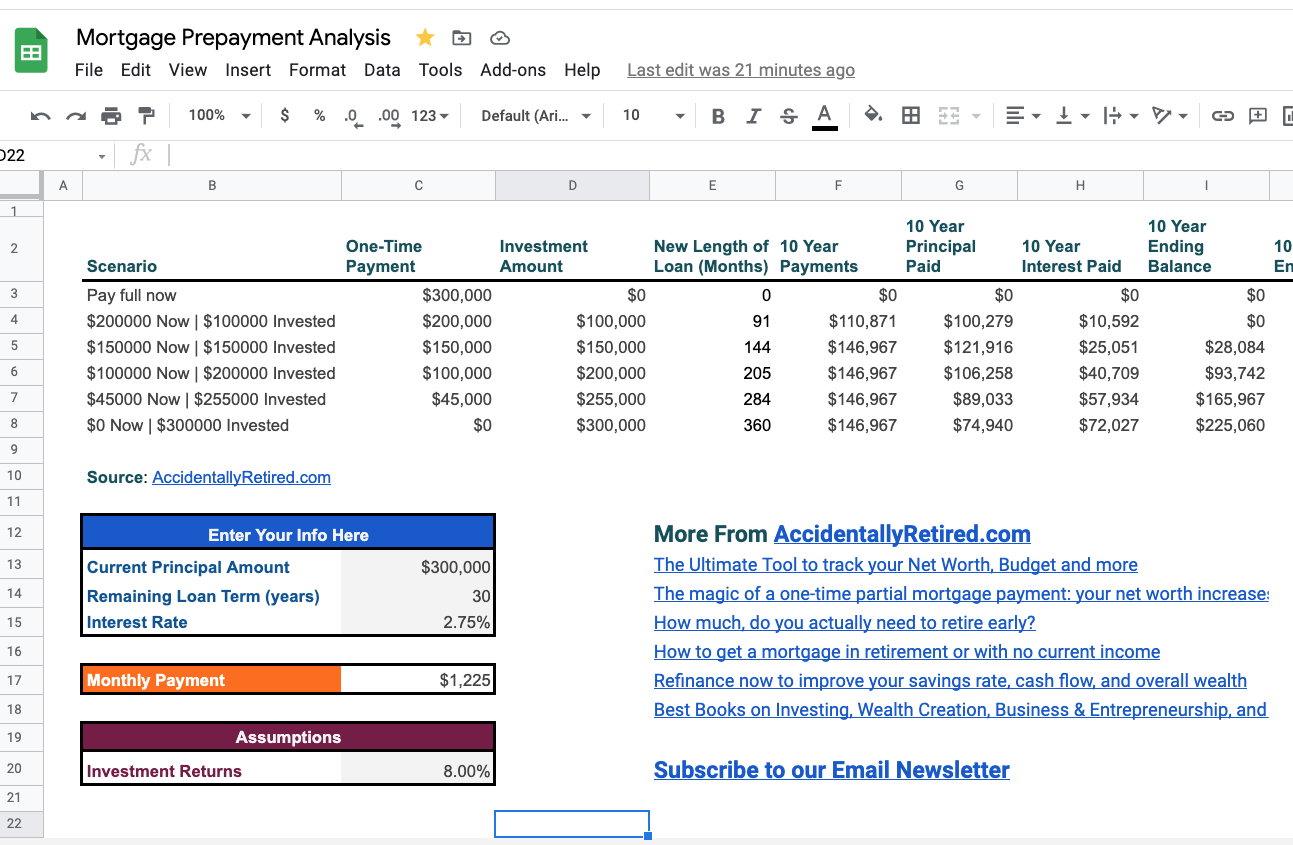

Pay Off Mortgage Vs Invest Calculator

Which States Are Best For Retirement Financial Samurai

Should You Have A Roth 401 K Or Traditional 401 K Saverocity Finance

Should You Have A Roth 401 K Or Traditional 401 K Saverocity Finance

Q A Should I Pay Off Mortgage With My 401 K

:max_bytes(150000):strip_icc()/what-is-the-rule-of-55-2894280-HL-668a4d7174d7461284f2ea41f450532c.png)

What Is The Rule Of 55

Suze Orman Pay Off Mortgage Instead Of Saving So Much For Retirement

X95vqhuxsyzzqm

Should I Use My 401 K To Payoff Mortgage When To Use 401 K To Payoff Mortgage If Retired Youtube

How To Retire At 55 Efficiently Guaranteed No Guesswork 2023

What Is The Rule Of 55 How Do I Use It To Retire Early

Here S What Happens To Your 401 K Loan If You Are Laid Off